Discover the FREE PLAYBOOK from World’s Best Marketers Claim Your Copy Now!

By on Dec 20, 2021

Financial hurdles are one of the very top reasons for business failures. 20% of small businesses close shop within the first year. 50% of businesses fail after five years, most of them due to problems with raising capital and cash flow. A lack of financing can be disastrous for your clients’ businesses, but obtaining proper funds doesn’t have to be that difficult.

You can help your clients explore alternative options other than looking for angel investors. For example, you can reach out to a white label financing company and get the required funding for your clients. Before you do that though, it’s important for you to understand what types of funding options are available for small businesses.

When you’re trying to get financing for your clients, you need to find someone that offers quick approvals and fast turnaround. And for that, Umbrella’s white label financing is one of the best options although some venture capital firms can also give your clients startup funds quickly. These funds can get your clients’ businesses off the ground or help them expand their current operations.

Umbrella offers several financing options to small businesses. Here are some of them.

One product available through Umbrella offers a startup advance with zero percent interest for almost two years. That can help your client pivot their business at the right time in a competitive market. This product requires a 660+ personal credit score from at least one guarantor to qualify.

Retirement Assets Based Funding is a great financing option for avoiding debt while starting or expanding a small business. Your clients can set up a Business Directed Retirement Account (BDRA) where they can invest retirement assets without taxable distributions or penalties. This allows for limitless investment from your clients, no banks, no credit checks and asset protection (meaning that there’s no need to put up collateral).

Small businesses that don’t have the credit history to secure large funds often face difficulty with financing. We help by holistically evaluating your client’s business and looking at cash flow and more, not just credit score, before deciding on the amount of funding. That way, your clients can secure up to $1million in funds in less than a week. All small businesses with a revenue report and cash flow details can apply.

We understand that expanding businesses need to secure funds in time or else they risk losing opportunities. We offer unique franchise funding options to your clients with low-interest rates of 6.25% to 7.25% and up to 25-year terms.

The process for acquiring SBA loans can be hectic. You can help your clients secure these funds through our white label financing service. We make sure to give your clients suitable terms for payback over 10 to 25 years with interest rates of 6% to 8%.

Overall, there are two main types of external financing: equity financing and debt financing.

Your clients can secure these from banks, venture capitalists or angel investors. You can get the funding for them through Umbrella. Established businesses have more options for raising capital than new businesses. For example, Umbrella only gives revenue-based advances when your clients’ have the revenue data to show their earnings.

Since new businesses have no track record of growth there is a higher risk of failure. That’s why it’s mostly easier for them to get equity financing than debt financing. But that’s not a rule. New small businesses or startups can secure debt financing from us. Especially if the business owners of the startup have good personal-credit scores, then that can help them obtain large amounts of debt financing with minimal interest.

Some entrepreneurs use multiple methods for raising capital. They go for different types of financing from various sources to reach the goals of investments for their businesses. But that option might be too sophisticated to manage for some of your clients. Statistics show that about 39% of small business owners use cash to start businesses while about 20% of entrepreneurs opt for a 401(k) business financing to get their companies off the ground.

Here’s an example that illustrates the importance of having enough financing to run a new business. Xinja was an Australian bank that successfully raised $100.62M. But it used up all the initial funding and eventually had to shut down after a year due to a lack of capital. Their business model was different from some other banks, so they heavily depended on the capital coming from investors to stay in business. They failed to secure enough funds in time and closed down for good.

You might not know this, but Steve Job’s company Apple was close to shutting down in 1997. It was saved by a $150M investment from Microsoft. Today, Apple is a household name but it came really close to being another failed tech company. That speaks volumes about how critical it is to get the necessary financing for your clients’ businesses in time.

Running out of money and cash flow are among the biggest challenges for small businesses. Small and mid-sized enterprises (SMEs) find it much harder to secure funding as compared to large enterprises. But a lack of capital should not be the reason for a business to shut down. Especially when there are many options to get the financing they need.

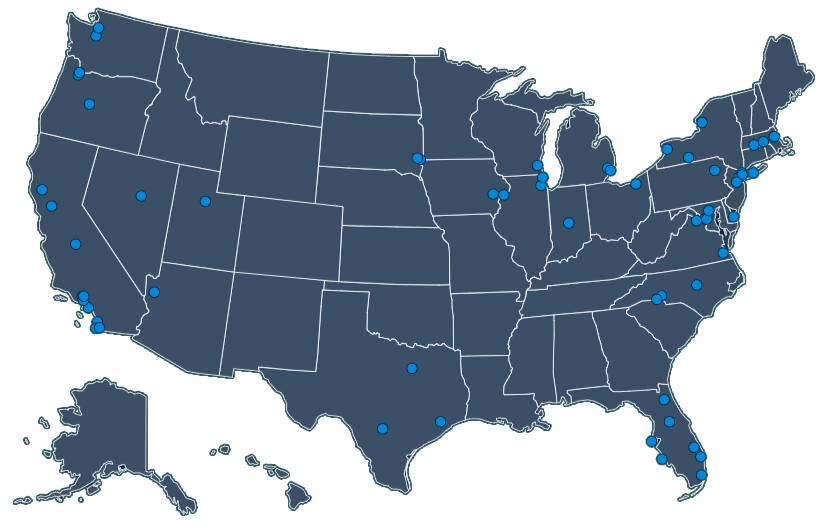

Umbrella is primarily a marketing agency, but we offer while label financing to small businesses through our partners. We can offer up to $500,000 in unsecured funds if your client meets the criteria. Contact Umbrella to see how you can help your clients get the money they need for starting or expanding their businesses.

Book a call today to discuss how we can help your marketing agency grow.